Home / Blog

Didn't Pay Student Loans Faithfully

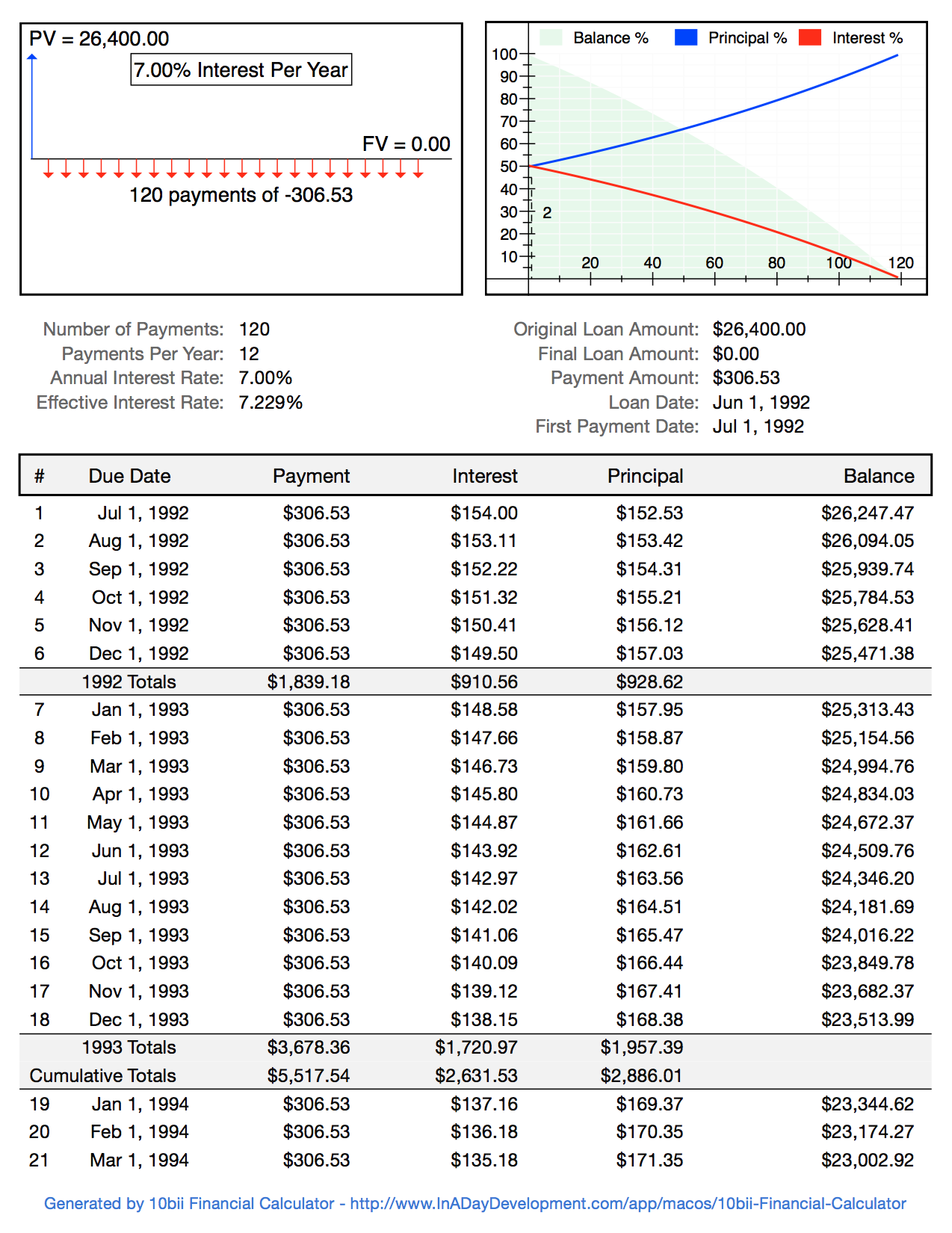

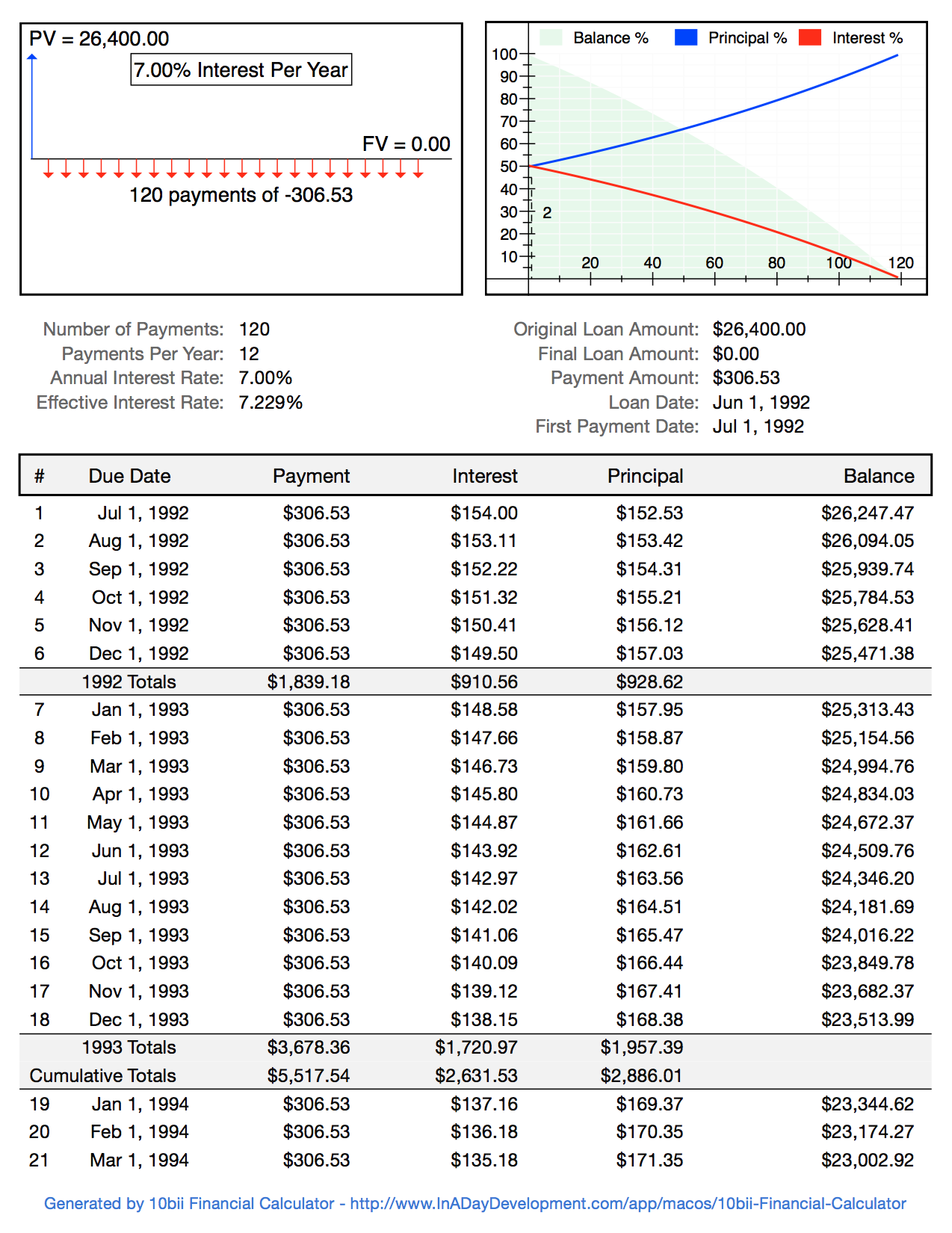

Student Loan debt IS a problem because university costs have inflated way too much, but please do not spread this image. I have no problem accepting all of the numbers on the paper could be true, but "paid faithfully" is total bullshit. Student loans are scheduled to be paid back in 10 years under Standard Repayment terms. The average rate 23 years ago was about 7% (not sure when this image was made, but let's just go back 23 years from when I wrote this). A $26,400 loan at 7% would have a monthly payment of $306.53. If she paid faithfully, it would have been paid off in 10 years. If she's only paid $32,700 over 23 years, that means she has only been paying $118.48 per month instead of $306. On the first month, the interest portion of her $306 payment is $154. So, she didn't even pay enough to cover the interest and therefore the loan balance increased. That means on the second month, the interest was slightly higher and her low payment covered it even less. Faithfully paying looks like this, because the loan balance goes down every month:

She didn't pay faithfully. My guess is that she either couldn't get a good enough job to pay the full payment amount or maybe she had a bad medical situation which consumed her finances and she wasn't able to pay, etc, etc... If she said, "I had a catastrophic medical emergency which takes all of my money so I'm not able to pay my student loans and I'm stuck forever..." then I would have more sympathy.

But paid faithfully? That's a lie.

Let's assume that it wasn't a medical emergency and instead she faced a common situation in which she couldn't find a high-paying job and simply couldn't afford her loan payment. Then she could have taken advantage of the Income-Based Loan Repayment terms. According to those terms, she would only have to pay 15% of her income toward the loan and whatever remained would be forgiven after 25 years. In that case, she would only need to pay for two more years and then her loan would be forgiven. If she's already paid $32,700 and she continued to make 24 more payments of $118.46 (the amount we calculated as her average payment amount), then her total out of pocket would be $35,543.04. The original loan, if paid faithfully, would have cost her a total of $36,783.17, so she would have paid $1,240.13 less and she would then be debt free.

Any way you look at this image, it's wrong or at the very least not trustworthy.

Student Loan debt is a real problem, but this is not an example of the real problem. Please do not pass this image around, because it hurts our chances at getting real reform. If opponents of reform see this image, they can tear it apart just like I can, but they'll just call her an entitled freeloader and discount all of the good arguments in favor of Student Loan Reform and Education Inflation.